TOP > Corporate Analysis Skills Training Course

Corporate Analysis Skills Training Course

Jump to external purchase page

A gem of a course on stock investment and finance with 650 minutes of total time and 350 pages of text.

I want to try stocks, but I don't know how to do it. I want to try stocks, but I don't know what to do. In the shadow of the recent venture boom, we hear more and more about finance and stocks, but not many people understand the essentials. Moreover, the discussion of stocks has been limited to people in the management level of companies, and there are still many things that are generally unknown to the general public.

In such a situation, I have seen people around me who have started speculative money management such as FX or Bitcoin. However, there are those who continue to ask the question, "What is the essence? I believe that there are only a handful of people who continue to ask the question, "What is the essence of investment? And what they all have in common is an understanding of finance.

The key to winning at the game of Othello is to take the four corners of the board. No matter how much the board is filled with opponents, you can win if you keep the corners in check. Knowing the essence of investing is similar to knowing this trick of taking the four corners. If you know the trick first, you will win in the end.

In this 650-minute video and set of analytical tools, we have prepared content that will help you learn the very essence of investing. In order to practice the basic investment principle of "buy low and sell high," you need to understand what is intrinsic value? to understand what the intrinsic value is. You will learn this procedure in 650 minutes of detailed lecture content, and you will be able to practice it using the tools.

You can learn from the 5 videos and practice with the tools.

Learning materials are provided according to your learning level! Instructor is Yohei Yamaguchi

Corporate Valuation in 5 minutes

This video introduces the basics of corporate value in finance. This part starts by finding out what is a stock price, which usually fluctuates. What exactly is a stock price? and how to play corporate value in corporate acquisitions in 90 minutes. In the case study, you will learn how to calculate stock prices by picking up figures from securities reports.

Includes 95 minutes of video and 37 pages of text.

Stock Investment Seminar Step Up Edition

This video teaches basic corporate analysis in order to become a wiser investor. You will develop your ability to grasp the state of a company by looking at the three financial tables (balance sheet, income statement, and cash flow statement) graphed to deeply understand specific companies. By the end of this part, you will understand how to proceed with corporate analysis and be able to grasp the characteristics from the information presented by the company.

100 minutes of video and 50 pages of text are included.

Seminar on Strategic Reading of Securities Reports for Individual Investors

This video is designed to learn how to read IR materials released by companies in order to further develop the basics. Securities reports are like dissecting tuna. By understanding what is written where and how to read them, you can gain a deeper understanding of the company's business. In this part, we aim to help you understand the business in detail and analyze the business structure, whereas in the past you have only had a superficial understanding of the contents of the report.

Includes 195 minutes of video and 105 pages of text.

Scenario analysis using PER

This video provides insight into scenarios for future growth. This may be especially important for those who have a long-term style of holding stocks. Considering the path a company will take in the future, how much will the future value of the company be, and is it best to invest now? The video explains how to think about this.

Includes 75 minutes of video and 105 pages of text

Cash Flow Valuation Edition

This video is designed to comprehensively train your analytical skills. The content begins with a review of the concept of corporate value, and then you will actually create a worksheet to forecast future sales and profits of a company and calculate its corporate value. If you are able to calculate free cash flow by yourself and play valuation, you are already a full-fledged professional.

Includes 190 minutes of video and 72 pages of text.Instructor Introduction

Yohei Yamaguchi

Business entrepreneur and thinker / President, Blue Marlin Partners K.K.

Graduated from Waseda University, School of Political Science and Economics (Azusa Ono Scholarship) and the University of Tokyo with a Master's degree. After working in M&A at a major foreign consulting firm since 1999, he was involved in corporate revitalization for Kanebo, Daiei, and other companies before starting his own business. In 2010, he sold the business, but later revived it. He was involved in the launch of Krispy Kreme Doughnuts in Japan, the launch of an e-commerce platform (later acquired by DeNA), and the founding, investment, and financing of space development and electric vehicle (EV) businesses.

He specializes in monetary theory and information society theory. Appeared as a commentator on NHK's "Nippon no Dilemma," TV Tokyo's "Opening Bell," TBS's "6 O'clock News," Nikkei CNBC broadcasts, and on the Special Mission Committee on Fiscal Reconstruction, Subcommittee on Post-2020 Economic and Fiscal Concepts. Part-time lecturer at Keio High School and lecturer at Yokohama City University, Fukui Prefectural University, and other universities.

He is the author of "The New Book of Stocks That Japanese People Didn't Know" (Random House Kodansha), "Due Diligence Professionals Teach Corporate Analysis Skills Training Course" (Nippon Jitsugyo Publishing), "How to Create a Company that Changes the World" (Blue Marlin Partners), "For Those Who Are Thinking of Quitting Their Jobs, Let's Share the Knowledge That Will Allow You to Eat Alone" (Blue Marlin Partners). Why was Van Gogh poor and Picasso rich? (Diamond Inc.), "What you should learn now to survive even if the world breaks down in 10 years" (SB Creative), and others.

In addition, he is also the author of "The Guide to the Performance of Listed Companies," which is used by 10,000 individual investors.

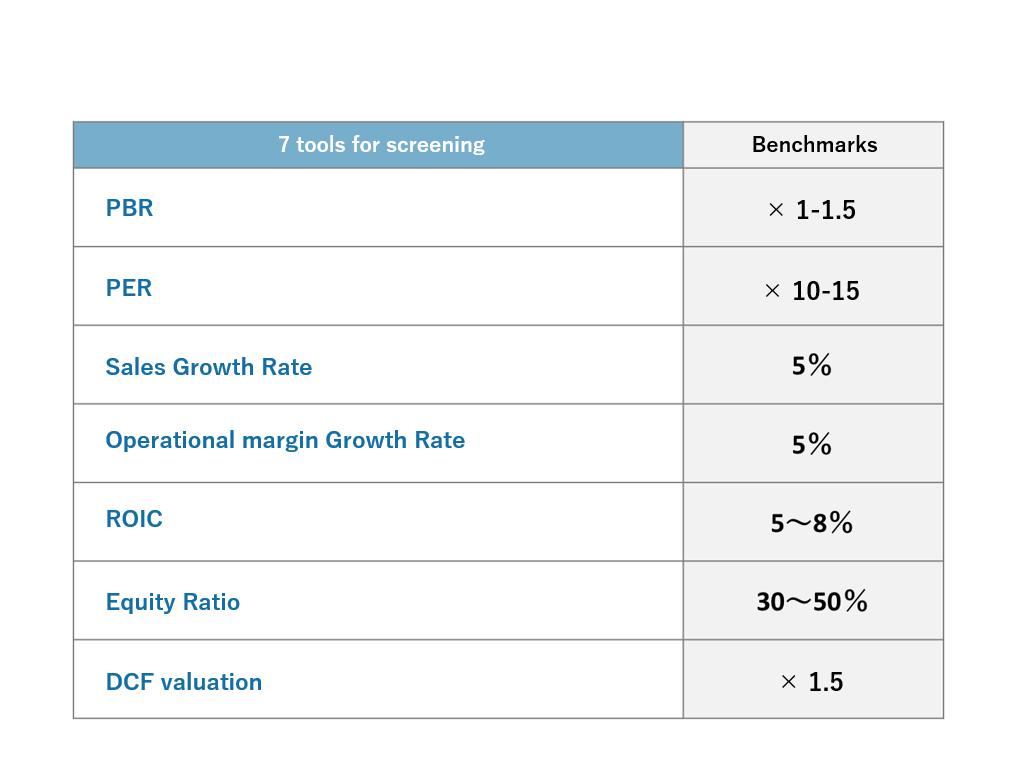

A corporate analysis tool that intuitively shows the performance of listed companies

Valuation Matrix, a tool used by 10,000 individual investors to intuitively analyze the performance of listed companies, can be used for one year (worth 30,000 yen).

Features of the Valuation Matrix

1. Pick up stocks recommended by M&A consultants

2. You can roughly evaluate the corporate value of stocks of companies you are interested in to see if they are a good value for your money.

3. Financial information can be viewed in graph form, reducing the time spent looking at financial statements to zero minutes.

Jump to external purchase page

5-minute introduction to the Corporate Valuation section of the video.

Each video is accompanied by a text that follows the content of the video material. The text includes explanations of the content as well as case study questions and answers.

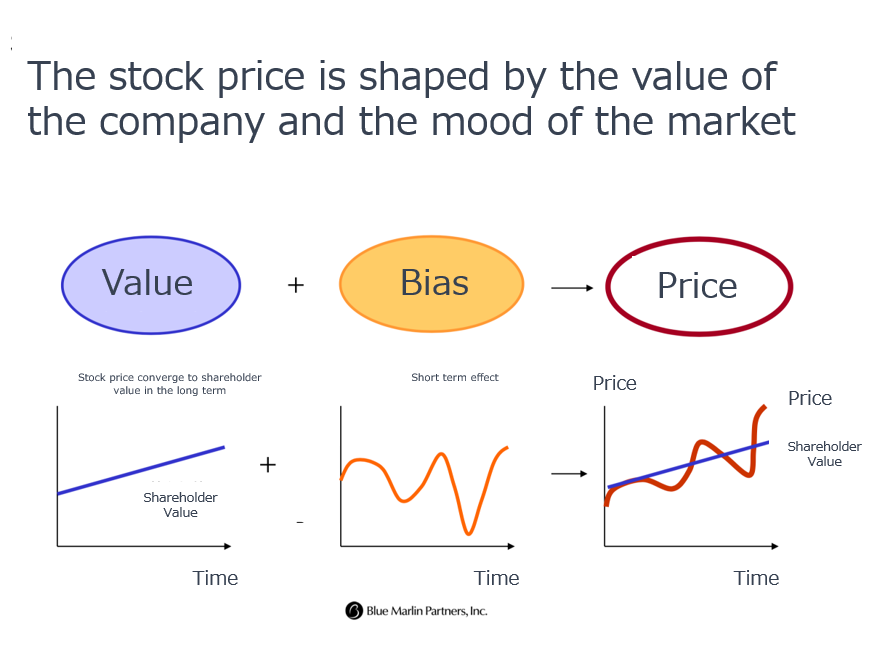

This section introduces the basic ideas about stock prices that are touched on at the beginning of the 5-minute Quick Corporate Value Evaluation section. It covers a wide range of topics, from the basic key to knowledge for professionals who calculate corporate value.

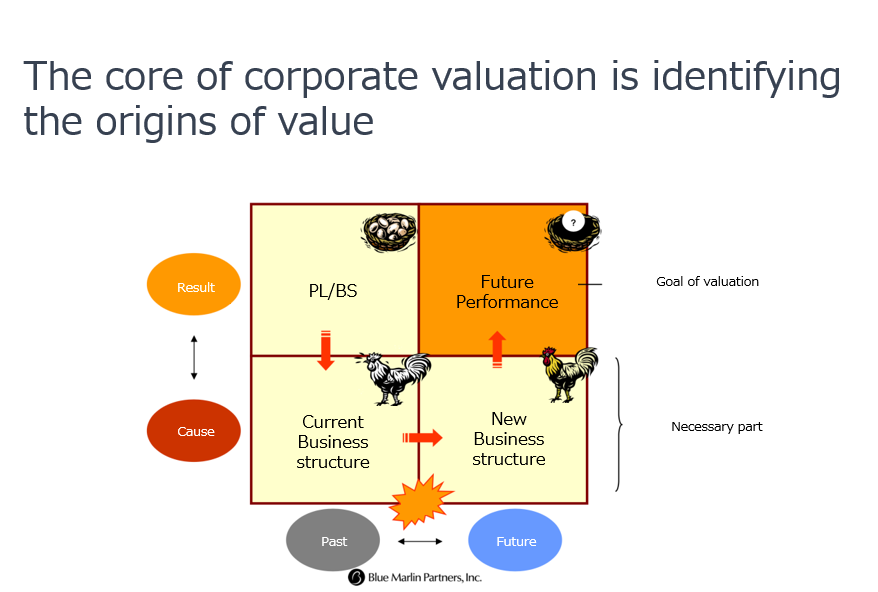

The positioning of each of result and cause, past and future, which is the base of the concept of corporate analysis, is explained in an easy-to-understand manner. In the video, it is read as a matrix of cause and effect, but it is also a video that can help you develop the habit of thinking about things in terms of a framework.

Testimonials

40s, programmer (male)

It was meaningful for me to think about "a good company" and "true growth," which I had not really thought about before. In particular, the perspective of how the value of the company increases by considering each scenario of the company's growth was something I had never seen before.

Company employee (male), 30s

I think the explanations and materials were of extremely high quality. Case studies are included in every session, so I am sure I will be able to improve my skills if I put in the effort.

Company employee (female), 30s

I have studied in books, but the parts I was unclear about were cleared up. It gave me a chance to want to study more and I think it will be useful for me in the future because I have the basics down.

Company employee (Female), 30s

Considering the richness of the contents and what I was able to learn, I was so satisfied that I thought the price was too cheap. I think the contents were understandable even for beginners, and I recommend it to intermediate and advanced students as well, because I think they will be able to understand it systematically. I wish I had known about it earlier.

Frequently Asked Questions

Q. What do I get if I buy the product?

A. We will send you a URL and login ID to the e-mail address you provided at the time of purchase in order to provide you with an environment where you can view the video materials. You will be able to view the video materials in the Valuation Matrix, where you will be able to use the video materials and tools.

Q. What kind of viewing environment can I use to watch the videos?

A. The video materials in this product can be viewed in the Variation Matrix. They can also be viewed on your computer or smartphone. The text can also be viewed on your computer. If you have a preference for a viewing environment, we can accommodate your needs.

Flow after purchase

After purchase, the support desk will send the URL of the video viewing page and the text download link to your registered e-mail address. Please download or print the text for your use.

You can watch the videos in ValuationMatrix from the URL attached to the email or from your My Page.

You will have access to the same paid features within ValuationMatrix as the New Investor Plan for one year.

Jump to external purchase page